You may have experimented with blockchain projects to drive transparency in your supply chain or efficiencies in cross-border payments. You may have live AI-driven applications in customer services or backend automation. You may even be considering migrating your core infrastructure into the cloud to increase storage efficiencies and speed. But have you considered how these technologies should be integrated with each other to drive your core strategy now, and not just the periphery or on a ten year horizon?

The driver for innovation projects in incumbent organisations is largely to break down silos. Silos that exist both between internal business units and those with the outside entrepreneurial ecosystem. The new challenge is that these innovation projects are now creating the next generation of organisational silos as they approach each new technology project in an individualistic way. And these technologies do not exist in a vacuum. There is now a need to consider the interdependencies of AI, blockchain and cloud, and to strategise a holistic approach to implementing exponential technologies.

Will 2018 be the year blockchain and artificial intelligence meet?

Whilst the fundamentals of AI and blockchain may seem contradictory – with the former taking on a sensationalist image of a centralised super brain, and the latter being a distributed and democratic source — there are a myriad of ways that these technologies can interact with one another. An example of this interaction works like this:

For any dataset

• Blockchain technology can provide the trusted and decentralised source of truth;

• AI can execute decisions based on the analysis of the dataset; and

• Cloud computing can offer efficient and accessible storage as well as enabling agile updates to the decision-making process.

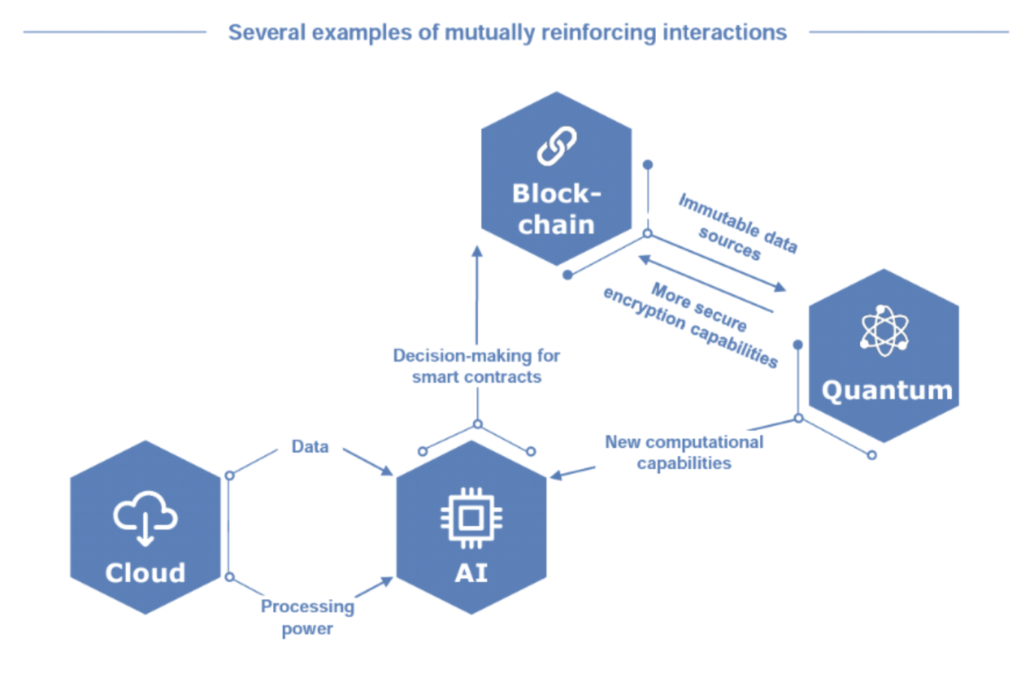

Thus, these technologies are mutually reinforcing and should be approached holistically. Focusing on the advancements of one technology alone does not allow you to explore the full range of applications it could have on your business. Their interactions will exponentially grow as they mature and continuously become more complex as other disruptive technologies reach mainstream adoption too.

One example is quantum computing, which would benefit the above example by driving the processing power required to execute the AI decision- making and improving the security of the data source and storage. This graph in Jesse McWaters ‘The new physics of financial services’ World Economic Forum report highlights the interdependencies of these four disruptive technologies:

The key to capturing the full potential of these technologies is unlocking the data playground. The tech giants (particularly in Asia) are leading the way in developing their core technology capacity and the data they collect to drive it.

Ant Financial for example, the Chinese tech giant that accounted for 35% of global venture capital investment in 2018 and now ranks in the top ten most valuable financial services firms in the world (according to CB Insights), has developed a BASIC model to drive its data strategy. For Ant Financial, BASIC stands for blockchain, AI, security, IoT and cloud and this approach ensures that the intersection of these technologies and the data that feeds their development, sits at the heart of its strategy. As Ant Financial expands across industry verticals through its omniscient super app for consumers and its new line of financial cloud services for businesses, it has positioned itself to acquire and utilise as much data as possible. This data-first approach and Ant’s ability to test and evolve future technologies by leveraging this data, means that its competitive advantage becomes a self-fulfilling prophecy.

Gartner: top 10 data and analytics technology trends for 2019

Uber’s new technology project, Michelangelo, is another great example of how to put data at the heart of the organisation. Michelangelo is a machine-learning-as-a-service platform that makes Uber’s data accessible internally to test and deploy models, monitor predictions and evaluate new ideas. One year in, Uber has recognised incremental improvements across its product range. This approach both reduces the cost of experimentation and ensures projects proven viable are directly scalable across the business as data silos are removed.

Whilst AI, blockchain and cloud are often overhyped and misused for innovation theatre, the advancements made by those at the cusp of technology development are clear. Financial institutions should consider how to leverage the true value of data before the competition does. To quote McWaters “AI is not a tech problem, it is a data strategy problem”.

Join us at Money20/20 Europe this June in Amsterdam, as we dive further into the game-changing stories and trends, driving forward the global Financial Services, Payments and FinTech community.