Gartner predicts that a quarter of a billion connected vehicles will be on the road by 2020. The Internet of Things is infiltrating every aspect of day-to-day living and the latest addition is the connected car.

Connected cars have the potential of making lives more convenient, journeys greener and roads safer, but what about the impact on supporting industries?

In order to effectively insure an industry, providers must understand each and every characteristic that could impact a claim.

With about 100 million lines of code, a modern, top-of-the-range limo has a higher amount of software than a state-of-the-art jetliner.

>See also: Connected car security: why identity should be in the driving seat

The make-up of the motor industry and the cars they are producing are entirely different to just 10 years ago.

Instead of manually plugging in tools like TomTom navigators or car phones, cars come installed with software ranging from GPS to Bluetooth. Insurers must adjust accordingly.

Connected car services impact the whole driving experience. Everything from traffic safety and infotainment, to cost efficiency and convenience are undergoing a digital transformation.

Drivers can now receive notifications about speed, potential hazards and real-time traffic, fuel-price or maintenance recommendations.

It doesn’t stop here. In-car technologies can gather information about speed, steering and braking inputs.

Snapshots of information related to an event or incident can be recorded for future analysis of vehicle dynamics, driver inputs, seatbelt usage or airbag deployment.

This level of transparency, insight and evidence is staggering and has the potential to revolutionise traditional ‘box-ticking’ insurance processes.

The insurance industry must transform at the same pace if providers wish to remain relevant. The vast majority of connected car owners expect the same connected experience they are used to at home, at work and on their mobiles.

Therefore, their experience with their insurance providers must be equally digital, convenient and relevant to their everyday lives.

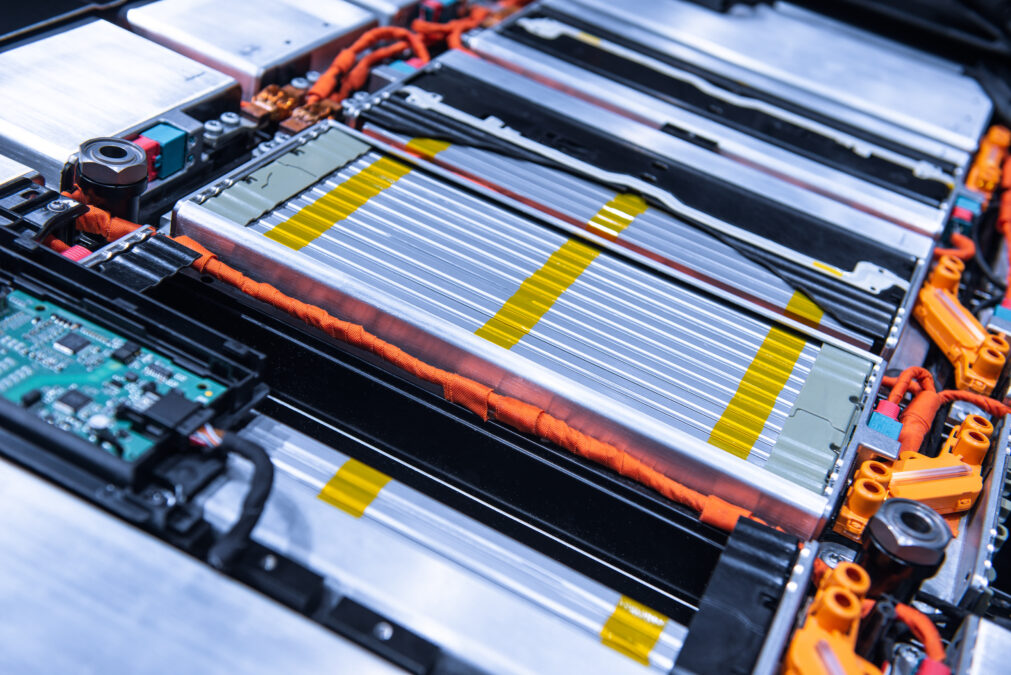

Data-driven journeys, electric cars, driverless technology and on-demand services such as Uber and Hailo are becoming increasingly commonplace.

Insurance providers must assess what kind of insurance models these need: where does liability sit and do premiums fall? Consumers will expect answers or will look elsewhere.

Theoretically, the sharing of data between manufacturers, insurers and drivers could result in the most accurate insurance quotes and claims to date.

Based on driver behaviour, insurance companies can offer flexible usage-based fees as opposed to building premiums around assumptions like age, mileage, type of vehicle or purpose of driving.

Additionally, liability is shifting from the driver to service providers like Uber or ZipCar, or even to the manufacturer for future self-driving cars.

While the industry remains in flux, competition is likely to increase as manufacturers enter the insurance game and capitalise on their relationships with customers and digital expertise.

>See also: Can car manufacturers navigate the new digital driving culture?

Self-driving cars effectively make insurance a warranty product. Staying ahead of the curve, shredding legacy systems and processes and offering a customer-centric experience will be key if traditional insurers want to secure their position in the marketplace.

If these changes take too long to implement, the whole car insurance market could be dead within ten years.

Before long, the number of connected cars on our roads will outnumber those that are not. Safety, energy efficiency, driver experience and the very nature of car ownership are set to change forever.

The question remains: will insurers keep up and provide the level of service that customers are coming to expect?

Sourced from Edo Tealdi, MD, digital, NTT DATA