Britain’s unexpected decision to leave the European Union earlier this summer had initially provoked uncertainty and ambiguity in the UK technology and M&A industry.

However, markets bounced back quickly, and M&A transactions – particularly those with a technology focus – have seen a flurry of activity since then, with foreign investors seizing what is now seen to be a unique opportunity.

Before the vote, M&A activity had rocketed in previous years, with the global market valued at a staggering $4 trillion.

This year alone, an estimated 18,000 M&A transactions are expected to take place, with the market showing no signs of slowing down.

>See also: Fintech M&A slows down: should the industry be worried?

But what has led us to this point? In order to achieve a better understanding of technology M&A in the current climate, it may be useful to consider how this trend has developed over time.

All the way back in 1775, someone called Matthew Boulton, then co-owner of a successful metal-working business, bought out the two-thirds interest John Roebuck held in James Watt’s condensing steam engine for £1,200.

Amounting to just over £100,000 at current prices, this would prove to be not only the bargain of the century, but of two, as their combined enterprise became the ubiquitous provider of motive power for the industrial revolution of the 17th and 18th centuries.

The next significant development in this industry was seen almost 100 years after the Joint Stock Companies Act of 1862, which marked the birth of shareholder capitalism and the separation of the creation of value in businesses from the entrepreneurs behind them.

>See also: Hackers won’t wait for the GDPR or Brexit and neither should you

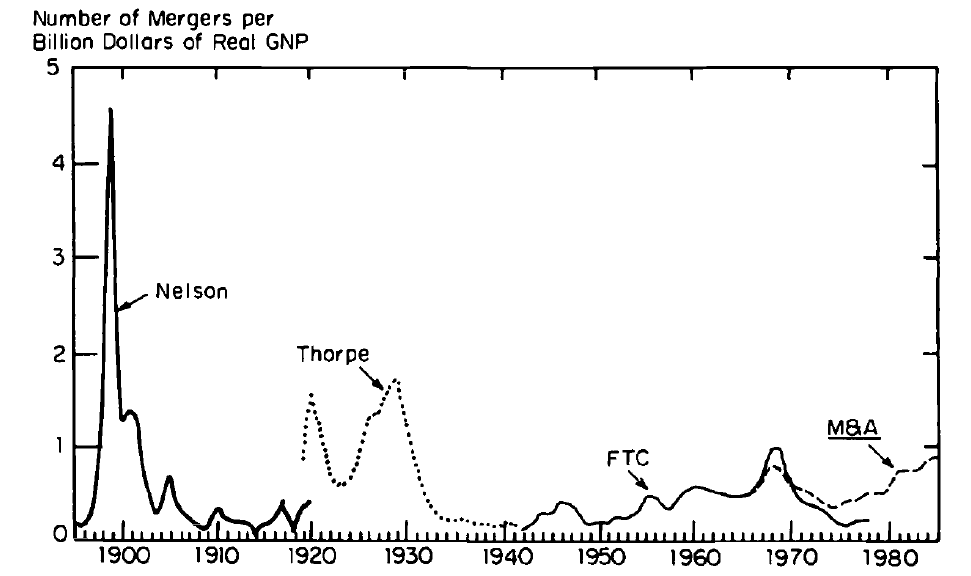

The rise of incorporation also created shareholder reporting and regulatory filing obligations that began to provide reliable M&A data.

As a result of these developments, technology M&A activity was flourishing by the late nineteenth century – see chart below.

Technology was continuing to develop and increase in capital. Alongside this, widespread shareholder capitalism contributed to this buzz of technology M&A as businesses were able to be traded and combined easily.

The advances we have seen in technology M&A since then started with the creation of Standard Oil in 1882 and the first billion-dollar public company, U.S. Steel in 1901.

The biggest deal (in nominal terms) of all time is AOL and Time Warner in the year 2000. As technology continues to reinvent itself, M&A activity will continue to capitalise on these opportunities.

The future for the technology M&A industry looks resilient and is set to overcome the initial uncertainty caused by Britain’s decision to leave the European Union this year.

In recent weeks, Livingstone has experienced a steep rise in activity surrounding technology M&A, including our work with CSL Dualcom, an international Critical Connectivity provider specialising in machine-to-machine communications, which has been acquired by Iconiq Capital, Norland Capital and RIT Capital.

>See also: Why London will remain a global tech hub post-Brexit

A number of high-profile acquisitions have been made in the retail sector, as well, as recently seen with TriStyle Group’s acquisition of Long Tall Sally.

These recent transactions confirm that the UK’s vote for Brexit has not negatively affected M&A activity to the degree that many expected.

In fact, industry has seen the complete opposite effect.

The long history of successful M&A technology transactions looks unlikely to end anytime soon.

Sourced by Nick Field, associate director, Livingstone