Jobs within the UK Fintech space increased by 61% last year, whilst demand pushed up salaries by as much as 25% — according to the findings from the UK Fintech salary report from global recruiter Robert Walters and market analysis experts Vacancy Soft.

London: the centre of UK Fintech and beyond…

London continues to be the number one city in Europe, attracting venture capital funding for its numerous Fintech’s — 39% versus Berlin (21%), Paris (18%), Stockholm (5%), Barcelona (4%), Amsterdam (4%), Zurich (3%), Copenhagen (2%) and Dublin (2%).

This seems to be having an upward push on Fintech salaries. Indeed, the report notes a salary leap of 20% between roles advertised for SME Fintechs with no funding versus roles advertised for VC backed enterprises.

Danika Jarmer, director — strategic accounts at Robert Walters said: “The rise of fintech comes at a time where talent shortages are felt across major professional disciplines, and so VC funding is acting as somewhat of a ‘game changer’ when it comes to attractive job offers.

“As an increasing number of Fintechs gain backing, capital is becoming less of a constraint and so firms can afford to offer inflated salaries in order to secure the best talent.”

According to the report, IT vacancies absorbed half of the Fintech hiring market in 2017. But, this figure has dropped by 7% in 2018 as business growth and preparation for Brexit calls for skills in other areas.

Ahsan Iqbal, director — technology at Robert Walters said: “The level of hiring activity is largely driven by the hype of international expansion, fuelling job creation and in turn, significant salary jumps. With 42% of roles in fintech dedicated to IT, we’re seeing on average 8% year-on-year salary growth for IT.”

Revolut CEO: UK needs specialised tech Visas if London is to remain the fintech powerhouse

Demand for Fintech skills outside of IT

Outside of IT, the rapid growth of UK Fintech businesses has stimulated demand for skills in other areas — namely Compliance (85% YOY growth), Marketing (63% YOY growth), Sales (23% YOY growth) and Development & Engineering (16% YOY growth).

James Murray, director — financial services at Robert Walters said: “It is no surprise to see compliance as the largest growth area this year. The spotlight on fintech’s has meant that they are now having to address concerns from regulatory bodies and prove that they are just as capable of being compliant as the big banks. With relatively unestablished compliance departments, we can expect to see rapid hiring in this area for the rest of this year.

“Over the next 12 months, we can expect to see the greatest salary movement in the high-demand skills areas, where skills shortages are experienced the most acutely. If fintech businesses are to effectively compete against financial services giants with significantly more capital, they will need to ensure their employment packages are premium, factoring in progression, work-life balance and a positive business culture, on top of a healthy salary.

“One particular advantage for fintech’s is their capacity to offer equity to employees, which big banks can not directly compete with.”

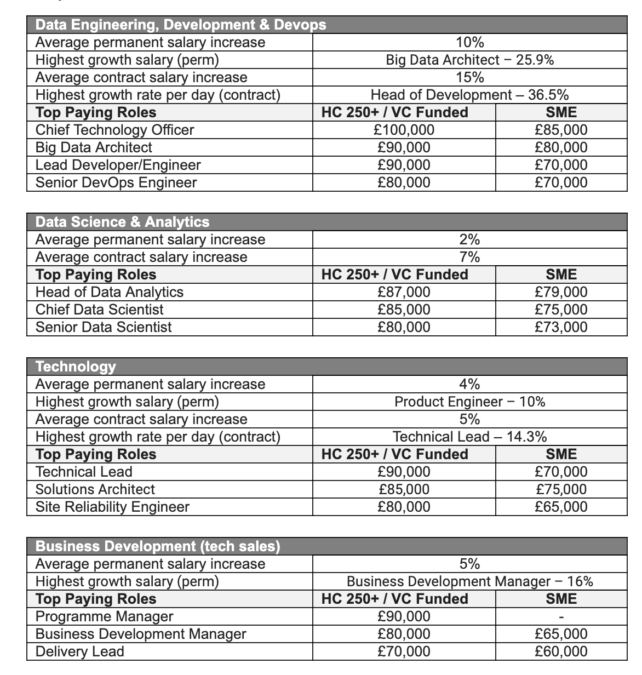

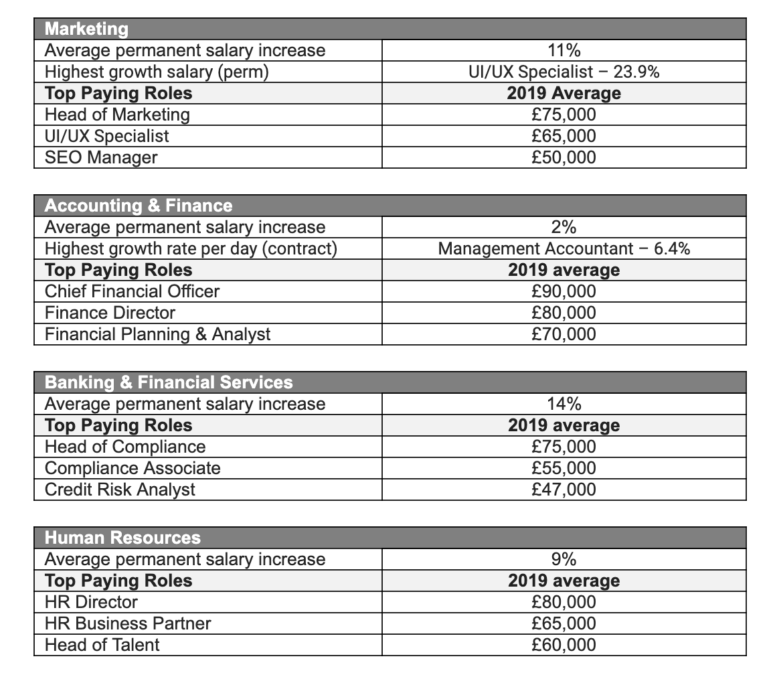

Hotspot roles and UK Fintech salaries: