5G networking infrastructure market revenue will almost double in 2020 to reach $8.1 billion, according to the latest forecast by Gartner.

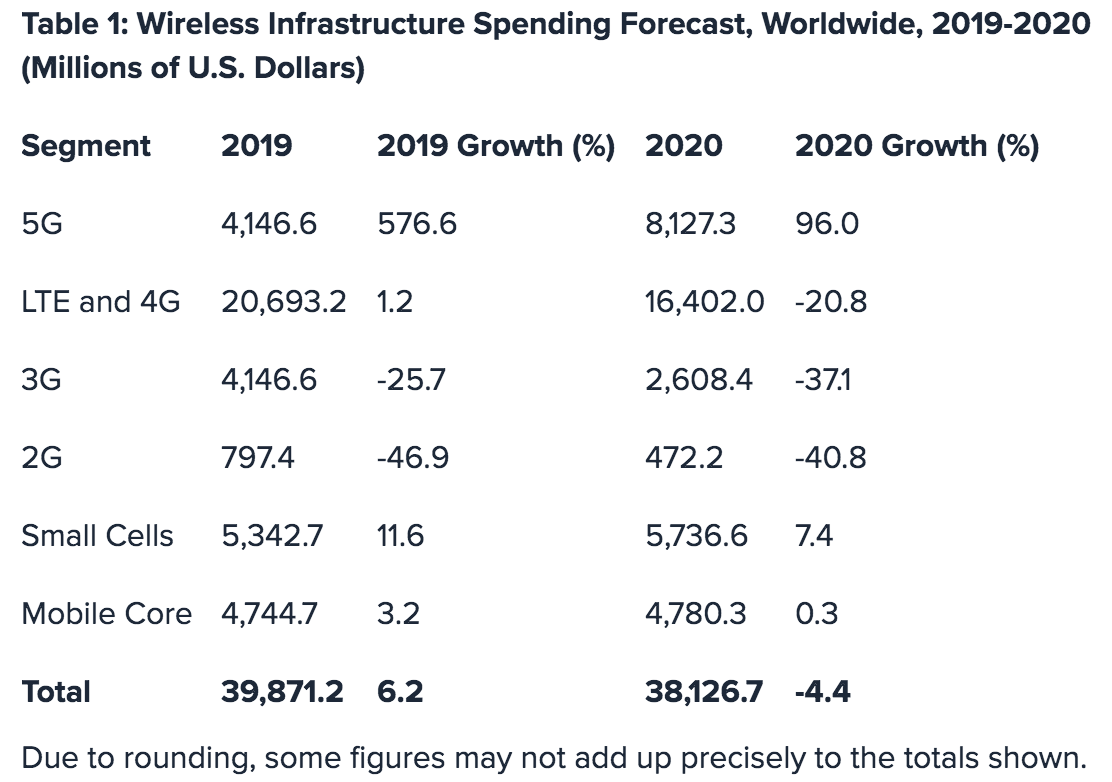

Total wireless infrastructure revenue is expected to decline 4.4% to $38.1 billion in 2020.

Investment by communications service providers (CSPs) in 5G network infrastructure accounted for 10.4% of total wireless infrastructure revenue in 2019. This figure will reach 21.3% in 2020 (see Table 1).

“Investment in wireless infrastructure continues to gain momentum, as a growing number of CSPs are prioritising 5G projects by reusing current assets including radio spectrum bandwidths, base stations, core network and transport network, and transitioning LTE/4G spend to maintenance mode,” said Kosei Takiishi, senior research director at Gartner.

“Early 5G adopters are driving greater competition among CSPs. In addition, governments and regulators are fostering mobile network development and betting that it will be a catalyst and multiplier for widespread economic growth across many industries.”

Increased competition among CSPs is causing the pace of 5G adoption to accelerate.

Gartner suggests that new O-RAN (open radio access network) and vRAN (virtualised RAN) ecosystems could disrupt current vendor lock-in and promote 5G adoption by providing cost-efficient and agile 5G products in the future.

The research organisation predicts that CSPs in Greater China (China, Taiwan and Hong Kong), mature Asia/Pacific, North America and Japan will reach 5G coverage across 95% of national populations by 2023.

“Despite investment growth rates in 5G being slightly lower in 2020 due to the Covid-19 crisis (excluding Greater China and Japan), CSPs in all regions are quickly pivoting new and discretionary spend to build out the 5G network and 5G as a platform,” continued Takiishi.

How the UK can speed up 5G infrastructure deployment: necessary to innovate and compete in the global market

5G leader

Over the short-term, Greater China is leading the world in 5G development, with 49.4% of worldwide investment in 2020 attributed to the region.

Cost effective infrastructure manufactured in China, coupled with state sponsorship and reduced regulatory barriers is paving the way for major CSPs in China to quickly build 5G coverage.

“However, other early adopting and technologically adept nations are not far behind,” added Takiishi.

5G investment bounce back

Gartner expects that 5G investment will rebound modestly in 2021, as CSPs look to capitalise on changes in behaviour, which has been sparked people’s elevated reliance on communication networks.

As such, 5G investment will exceed LTE/4G in 2022.

Moving from 4G to 5G

CSPs will gradually add stand-alone (SA) capabilities to their non-stand-alone (NSA) 5G networks, and Gartner predicts by 2023, 15% of CSPs worldwide will operate stand-alone 5G networks that do not rely on 4G network infrastructure. This will rapidly divert wireless investment away from LTE/4G and spending on legacy RAN infrastructure will rapidly decline.