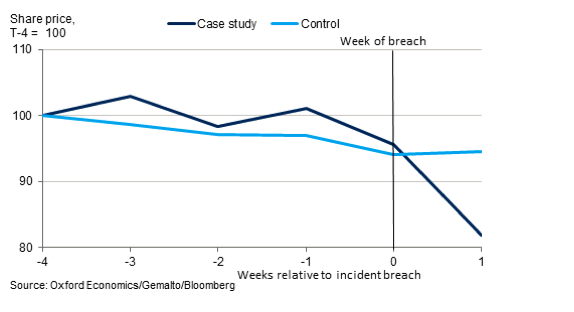

The cyber security threat is growing. It has grown to such an extent that a severe cyber security breach represents a permanent cost of 1.8% to a company’s value as measured relative to a control group of peer companies, according to a CGI report released today.

For a typical FTSE 100 firm this equates to a permanent loss of market capitalisation of £120 million, signalling a significant loss of value for shareholders.

“As identified in CGI’s Global 1000 Outlook report, cyber security is a still a top priority for businesses, but business leaders, policy makers and investors still have work to do to take cyber security risk far more seriously.” commented Andrew Rogoyski, vice president of cyber security at CGI in the UK.

“We are beginning to see City analysts, venture capital firms and credit ratings agencies factor cyber security readiness into the way they assess firms – this is positive and should encourage boards across the world to treat cyber security as an enterprise-wide risk.”

>See also: Elevating data risk management to the board level

The study is based on economic modelling from Oxford Economics, which conducted an ‘Event Study’ analysing a sample of public cyber security breaches since 2013 across seven global stock exchanges, based on information from the Gemalto Breach Level Index.

A sample of 65 ‘severe’ and ‘catastrophic’ cyber security breaches were then analysed to indicate the impact of these more significant attacks on company share price performance.

When the cumulative impact on shareholder value is considered the 65 severe cyber security breaches have cost investors £42 billion in total. However, it is important to note this figure includes only publicly known severe breaches – the true amount of company value lost due to cyber attacks is likely to be far higher.

Furthermore, the cost of cyber attacks to investors is likely to skyrocket in the near future, as the General Data Protection Regulation means firms operating in Europe must disclose cyber attacks.

Commenting on the report, Simon Moffatt, senior product manager at ForgeRock, said that “the damage caused by a cyber attack goes far beyond the direct cost of the hack itself; increasingly there is a significant reputational cost as well. With share prices falling by 1.8 percent on average following a severe breach, business leaders cannot afford to take security issues lightly.”

“All organisations should have fully documented data breach plans in place that both minimise risk and enable them to respond quickly and effectively to any issues. As more and more services are delivered through digital channels, implementing strong device and person-based identity and access management practices will also be critical.”

In Rogoyski’s estimation “only around 10-20% of the major breaches companies suffer in Europe are currently made public, so lost shareholder value across European markets could rise by as much as a factor of 10 when the new regulations take effect in May 2018.”

Ian Mulheirn, Oxford Economics, commented: “The study shows a significant connection between a severe cyber breach and a company’s share price performance. It was found that, on average, a firm’s share price was 1.8% lower in the wake of a breach than it would otherwise have been in the week following an attack. However, in some cases the relative share price fall for affected companies was much higher, with one attack lowering the company’s valuation by 15%.”

>See also: Financial firms in NYC face stricter cyber security regulation

He continued: “With this methodology it’s important to view such underperformance as a permanent impact on the firm’s overall performance. That’s because a firm’s share price reflects market participants’ expectations of future profitability as markets ‘price-in’ such incidents. Therefore, the reaction of a company’s share price in the immediate aftermath of a cyber breach should be viewed as representing the permanent effect of the attack on the firm’s future profits.”

Rogoyski added: “In the US firms are already obliged to report a breach. The same will soon be true for companies conducting business across Europe when the General Data Protection Regulation (GDPR) and Network Information and Services Directive come into force in 2018. When that happens we are likely to see a rapid spike in publicly reported incidents in Europe and financial markets will respond accordingly. Company boards should be considering cyber security prevention and preparation as a critical way of protecting the interests of shareholders.”

>See also: IoT boom and GDPR raise the stakes of a cyber security breach

CGI’s recommended eight steps to achieve effective cyber security governance:

1. Appoint someone at board level to be responsible for cyber security with the authority and know-how to address the risks and demonstrate leadership during times of crisis

2. Include cyber security on every board agenda, reporting on: risk to the business, nature of sensitive data and mitigation progress at a minimum

3. Treat cyber security as a company-wide business risk and assess as you would with other key business risks such as major safety issues, environmental disasters and accounting scandals,

4. Ensure that the company understands the rapidly developing legal landscape that applies to cyber risk – in particular, begin preparing for the GDPR and NISD now

5. Get specialist expertise to advise and inform the board, whether from internal teams or external advisors

6. Set a programme of work to manage cyber risk, allowing a realistic time and budget

7. Encourage discussion about risk appetite, risk avoidance, risk mitigation and cyber security insurance

8. Assume that you have already been breached but you might not yet know about it. Take action to reassure yourself that no such attack has taken place but plan on the assumption that they have.