When niche customer relationship management (CRM) software vendor Talisma announced plans in October 2003 to acquire Pivotal, a supplier of mid-market CRM applications, the deal seemed straightforward. Amid mounting financial problems, Pivotal had been in ‘play’ for several months and its banking advisers were happy with Talisma’s $48 million cash offer. Moreover, the two companies’ product lines fitted well.

But one month later, while Talisma’s CEO, Dan Vetros, was in India checking on Pivotal’s offshore development organisation, two counter-bids rolled in.

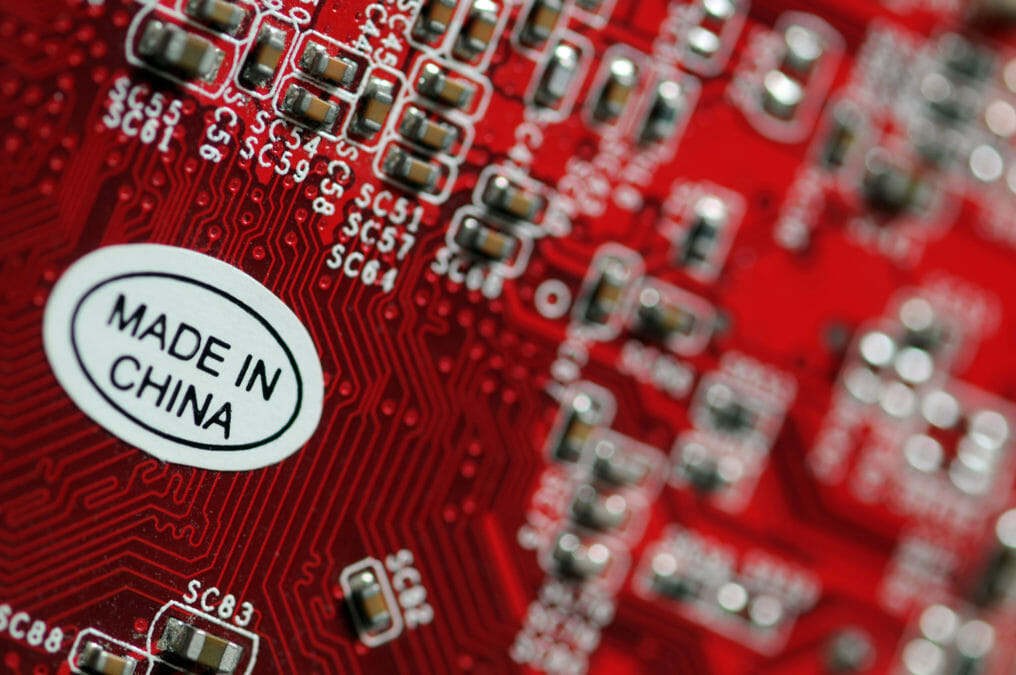

First came a $59 million all-stock offer from Pivotal’s bitter rival, Onyx. Then, almost out of the blue, came a $53 million cash and stock offer from a company that had not even made it onto Pivotal’s list of possible buyers – CDC Software, the enterprise software division of Hong Kong-based web portal Chinadotcom.

Initially, both counter offers seemed likely to be rejected. Talisma’s cash appeared more appealing than either Onyx or CDC stock, especially as a fall in Onyx’s stock price made its offer even less attractive. But when CDC matched Talisma’s cash offer and topped it up with Chinadotcom stock, the Pivotal board was forced to reconsider. At that point both Talisma and Onyx withdrew, leaving CDC as the unlikely winner in the three-sided contest.

Talisma’s Vetros says that he did not want to get dragged into a bidding war. He had spent six weeks conducting due diligence and he did not feel that Pivotal was worth more than $48 million. “We felt that the offer was fair, based on what we learned,” he says. CDC, buoyed by its strong position in the booming Chinese market, thought otherwise.

In any case, CDC is in the midst of an acquisition spree that shows little signs of slowing. As Talisma was preparing its bid for Pivotal, CDC swooped on process manufacturing software supplier Ross Systems and bought a controlling stake in supply chain management specialist Industri-Matematik International. Next on its list of targets, says managing director Steve Collins, is a discrete manufacturing software vendor to complement the Ross acquisition.

The company’s ultimate aim is to build a mid-market enterprise resource planning software business broadly modelled on UK mid-market supplier Sage. If that is the case, then this buying spree has barely started.