Pension funds from Scandinavia are pumping more capital investment into UK start-ups than their UK counterparts, research has found.

Pension funds from the Nordics: Denmark, Finland, Iceland, Norway and Sweden, have invested $88m (£70m) in total so far this year, contrasting with $49m (£39m) deployed by UK pension funds, according to London-based venture capital firm Atomico.

In July, Chancellor Jeremy Hunt unveiled pension reforms to allow capital from the UK pension pots to be funnelled into the country’s early-stage start-ups. Some pension funds, such as Aviva and Legal & General, agreed to place five per cent of their investments into private equity and early-stage businesses, potentially unlocking £50bn by 2030.

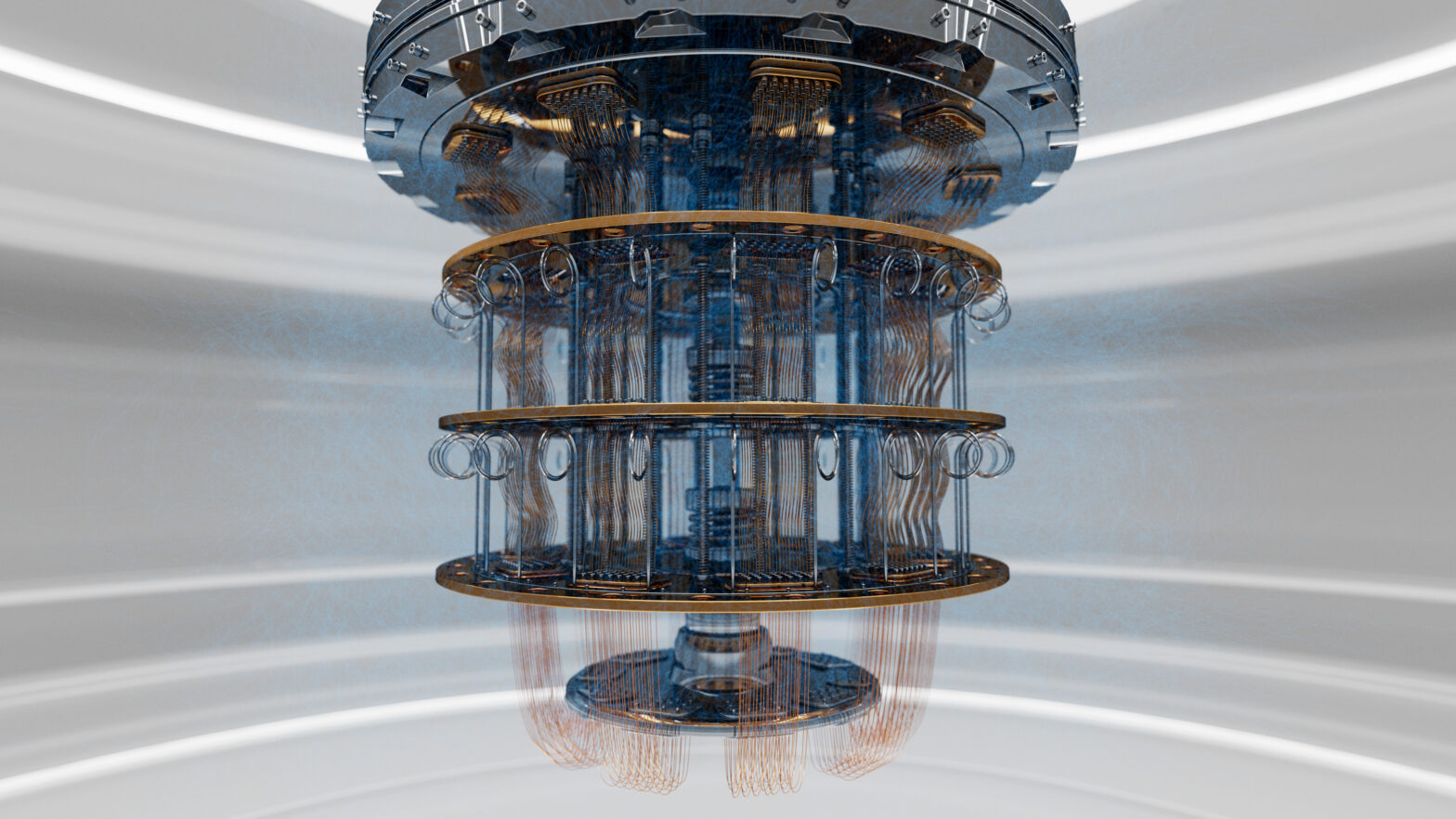

Chancellor to launch quantum supercomputing scheme in Autumn Statement — “Moonshots” aiming to establish quantum supercomputing leadership, including a national machine, are among future plans outlined by Chancellor Jeremy Hunt.

Despite an unsteady venture capital market, the UK remains Europe’s VC hotspot, attracting more investment than all other EMEA countries combined and second to only the US and China globally. However, a lot of this is due to overseas investors, notably from the US.

In recent months, however, it has become clear many US investors are turning their backs on European start-ups, which will collectively only receive $45bn this year compared to $82bn in 2022. The tech firms that are bucking the trend are those specialising in AI.

Last week, Hunt revealed plans to nurture homegrown investors specialising in AI, robotics and vaccines with a scheme akin to the Kauffman Foundation in the US.

The VC downturn is also having an effect on VC firms, with Forward Partners being bought by rival Molten Ventures in a £41m deal. Molten Ventures, a tech investor formerly known as Draper Esprit which has backed the likes of Thought Machine and Crowdcube, recorded a net loss of £243m in the latest financial year.

Related:

£200m digital skills training scheme launched by UK government — Government funding is to be aimed at digital skills training across high-growth UK sectors including green energy and construction.